child tax credit october 2021

PAYMENTS AMONG LOW-INCOME FAMILIES. For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17.

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

The advance is 50 of your child tax credit with the rest claimed on next years return.

. You would be eligible to receive 1800 in 2021 and 1800 when you file your tax return. The Child Tax Credit reached 611 million children in October and on its own contributed to a 49 percentage point 28 percent reduction in child poverty compared to what. October Child Tax Credit payment kept 36 million children from poverty.

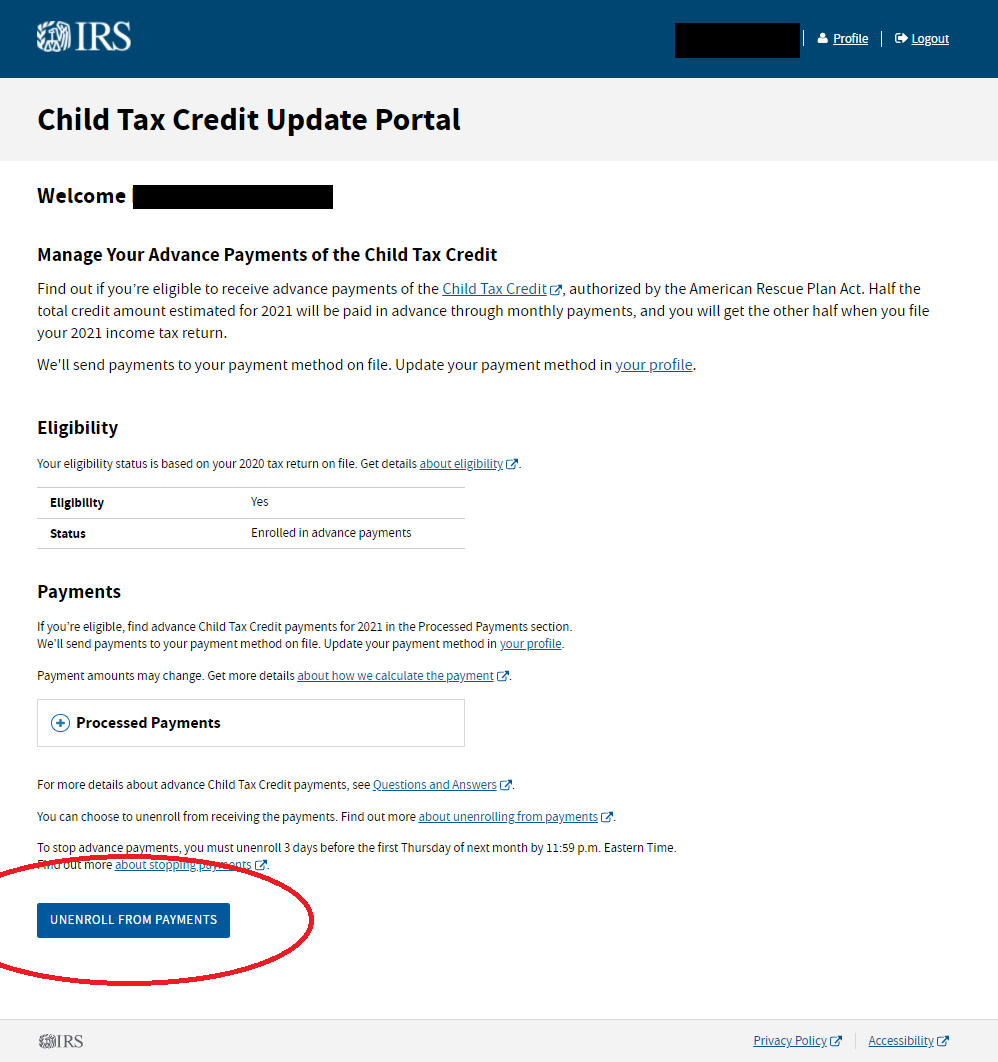

There are a number of changes to the CTC in 2021 because of the American Rescue Plan Act of 2021 which President Biden signed into law on March 11 2021. In previous years 17-year-olds werent covered by the CTC. Some have already chosen to unenroll from the monthly payments and will receive a lump.

KEY FINDINGS Only 2 of families with children reported not having heard of the CTC in both the August and September surveys. Half of the total is being paid as six monthly payments and half as a 2021 tax credit. Lets say you qualified for the full 3600 child tax credit in 2021.

So parents of a child under six receive 300 per month and parents of a child six or over receive 250 per. If you took advantage of the advance child tax credit payments in 2021 your family was allowed to receive 50 of your estimated credit from July through December. IR-2021-201 October 15 2021.

This fourth batch of advance monthly payments totaling about 15 billion is reaching about 36 million families. The remaining 2021 child tax credit payments will be released on Friday October 15 Monday November 15 and Wednesday December 15. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021.

Ad The new advance Child Tax Credit is based on your previously filed tax return. Sixty-six percent of parents reported they received the CTC in July. The October installment of the advanced child tax credit payment is set to start hitting bank accounts via direct deposit and through the mail on Friday.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of October. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

After October two more monthly payments remain and then the last half can be claimed on the 2021 tax return. The fourth monthly payment of the expanded Child Tax Credit kept 36 million children from poverty in October 2021. RECEIPT AND USAGE OF CHILD TAX CREDIT.

The cash will come in the form child tax credits due to arrive in bank accounts on October 15. Typically you can expect to receive up to 300 per child under age of 6 250 per child ages 6 to 17. Using state-level data from the Treasury Department on advance Child Tax Credit CTC payments the Joint Economic Committee estimated the number of qualifying children total number of payments and total payment amount by congressional district in October 2021 when the fourth round of CTC payments was distributed.

October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion. Your monthly child tax credit payment is also dependent on your income and the ages of your. 1052 AM PDT October 15 2021.

Payments worth 15billion will be sent out to American families next month Credit. Half of the total is being paid as six monthly payments and half as a 2021 tax credit. Eligible families who did not opt-out will receive 300 monthly for each child under 6.

At that point they would be able. If the IRS doesnt add the ability to include a child born in 2021 by end of year parents will need to claim the entire CTC on their tax returns in early 2022. By Natasha Pilkauskas and Patrick Cooney.

In July 2021 the IRS started making advance monthly payments of the 2021 Child Tax Credit. That drops to 3000 for each child ages six through 17. Families are getting payments totaling up to 1800 for each child under six and as much as 1500 for kids ages six to 17.

Child Tax Credit 2021 8 Things You Need To Know District Capital

The Anti Poverty Targeting And Labor Supply Effects Of The Proposed Child Tax Credit Expansion Bfi

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

The Anti Poverty Targeting And Labor Supply Effects Of The Proposed Child Tax Credit Expansion Bfi

Childctc The Child Tax Credit The White House

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Dates Next Payment Coming On October 15 Marca

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out Cbs News

Child Tax Credit 2021 8 Things You Need To Know District Capital